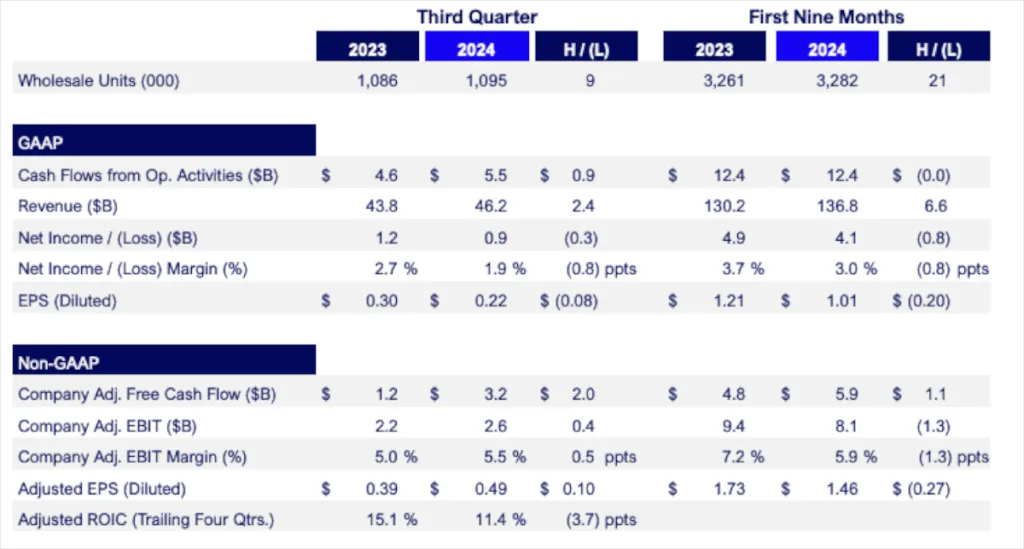

Ford Motor Company reported strong third-quarter 2024 results, demonstrating the effectiveness of its diversified product strategy and operational improvements. The company’s revenue reached $46 billion, a 5% increase year-over-year, driven by a robust product lineup that caters to both retail and commercial customers.

While net income declined slightly due to a one-time electric vehicle-related charge, adjusted EBIT improved significantly, driven by higher volume, favorable mix, and lower costs. Ford’s strong financial performance was further highlighted by robust cash flow from operations and a healthy balance sheet.

Key Highlights:

- Revenue: Ford’s third-quarter revenue reached $46 billion, marking a 5% increase year-over-year. This growth is attributed to a fresh and compelling product lineup that caters to both retail and commercial customers.

- Net Income: The company reported a net income of $0.9 billion, slightly down from the previous year due to a one-time electric vehicle-related charge.

- Adjusted EBIT: Adjusted EBIT increased by $352 million to $2.6 billion, driven by higher volume, favorable mix, and lower costs.

- Cash Flow: Ford generated strong cash flow from operations of $5.5 billion and adjusted free cash flow of $3.2 billion. The company ended the quarter with nearly $28 billion in cash and $46 billion in liquidity.

Business Segment Performance:

- Ford Pro: This segment delivered impressive results, with EBIT of $1.8 billion and a margin of 11.6%. The strong performance was driven by robust demand for Super Duty trucks and Transit vans, as well as the growth of Ford Pro Intelligence subscriptions.

- Ford Blue: The segment reported revenue of $26.2 billion, with growth driven by newly launched trucks and SUVs. However, EBIT was down year-over-year due to adverse exchange rates and higher manufacturing costs.

- Ford Model e: The electric vehicle segment continued to make progress, with significant cost improvements. However, it still reported an EBIT loss of $1.2 billion, reflecting industry-wide pricing pressures.

- Ford Credit: The finance arm reported strong earnings before taxes of $544 million.

Outlook for 2024:

Ford has revised its full-year 2024 outlook, with adjusted EBIT now expected to be around $10 billion and adjusted free cash flow between $7.5 billion and $8.5 billion. The company remains committed to its Ford+ plan, which aims to transform Ford into a higher-growth, higher-margin, and more capital-efficient business.

By focusing on its core strengths, embracing electrification, and leveraging its global footprint, Ford is well-positioned to navigate the challenges and opportunities of the automotive industry.

Discover more from Wheels Craze - Automotive News, EV News, Car News, Bike News

Subscribe to get the latest posts sent to your email.